As an Amazon Associate, as well as an affiliate of other programs, I earn from qualifying purchases. This may influence which products I write about and where and how the product appears on a page. However, this does not influence my evaluations or recommendations. My opinions are my own.

As the year winds down and the holiday season creeps closer, it’s easy to feel the financial pinch. Between gift shopping, holiday gatherings, and next year’s financial goals looming on the horizon, it can be overwhelming. With a little planning and some smart strategies, you can sail through the holidays and set yourself up for a financially successful new year—without the stress.

As the year winds down and the holiday season creeps closer, it’s easy to feel the financial pinch. Between gift shopping, holiday gatherings, and next year’s financial goals looming on the horizon, it can be overwhelming. With a little planning and some smart strategies, you can sail through the holidays and set yourself up for a financially successful new year—without the stress.

Whether you’re already a budgeting pro or just looking to get more organized, this guide is packed with practical tips that will help you manage your finances, save for the holiday season, and plan for the year ahead. Let’s dive in and get financially fit for the holidays (and beyond)!

Why Financial Planning Matters as the Year Ends

As fall ushers in cooler days and cozy vibes, it’s also a gentle nudge to review your finances before the year wraps up. The holidays are exciting, but they can also be a financial whirlwind. Taking time now to budget, save, and plan ahead ensures you’ll enjoy the festivities without the post-holiday financial stress.

Step 1: Set a Holiday Budget (And Stick to It!)

The holidays don’t have to derail your finances. A thoughtful, realistic budget is your best ally. It’s all about knowing your limits and planning ahead so you can celebrate without worry.

How to Create  a Holiday Budget:

a Holiday Budget:

Make a List (and Check It Twice): Write down every holiday expense—gifts, travel, meals, decorations, and even small costs like holiday cards or party supplies.

Set Spending Limits: Allocate a specific amount for each category and, most importantly, for each person on your gift list. This helps you avoid overspending and focus on meaningful gestures.

Start Early: Give yourself plenty of time to shop for deals, compare prices, and avoid the chaos of last-minute purchases. Planning ahead means more savings and less stress!

Pro Tip: Track your spending as you go to ensure you stay within your budget. Apps or simple spreadsheets can help keep things organized and on target.

By setting clear goals and boundaries now, you’ll feel more in control, enjoy the season guilt-free, and start the new year on a financially strong note. 🎄💸

Step 2: Prioritize Saving (Even During the Holidays)

Step 2: Prioritize Saving (Even During the Holidays)

The holidays are all about giving, but don’t forget to give yourself the gift of financial stability. Prioritizing savings during this festive season can help you avoid a post-holiday financial slump and start the new year strong. Even small steps can make a big impact!

Tips for Saving During the Holidays:

Automate Your Savings: Set up an automatic transfer to your savings account each payday. Even a modest amount adds up quickly and creates a safety net for unexpected expenses.

Maximize Cashback and Rewards: Use cashback apps, store discounts, or credit card rewards to help offset the cost of gifts, meals, or travel. It’s like getting a little holiday bonus!

Plan Ahead for Next Year: Start a holiday savings fund for the future by setting aside a small amount every month. A little planning now means less stress next December.

Pro Tip: Save your spare change—it might sound small, but by the time the holidays roll around, you could have enough for a thoughtful gift or to treat yourself. After all, it’s not about the price tag, but the meaning behind the gesture. ✨

By keeping savings in focus, you can enjoy the holidays guilt-free and step into the new year with confidence and financial peace of mind. 🎁💰

Step 3: Smart Ways to Save for the Holidays: Where to Trim the Fat 🎄💰

The holiday season is right around the corner, and it’s the perfect time to reassess your spending habits. By making a few simple adjustments, you can free up extra funds for thoughtful gifts, festive celebrations, or maybe even a little splurge for yourself.

Here are some  easy ways to cut back without feeling deprived:

easy ways to cut back without feeling deprived:

1. Audit Your Subscriptions:

Take a closer look at those monthly fees. Do you need all five streaming services, or could you stick with just one until the new year? Cancel or pause subscriptions that aren’t essential right now—it adds up quickly!

2. Dine In, Not Out:

Cooler weather is an invitation to embrace cozy, homemade meals. Cooking at home not only saves money but often feels more festive (hello, hearty soups and fresh-baked bread!). Bonus: it’s usually healthier too!

3. Pause on Impulse Shopping:

That cute gadget or sweater in your cart? Try the “24-hour rule.” Wait a day before buying to decide if it’s a want or a need. Chances are, you’ll find it wasn’t as necessary as it seemed in the moment.

Pro Tip: Channel the money you save into a “holiday fund” jar or savings account. Watching it grow will make your financial discipline even more rewarding!

These small changes can make a big difference and leave you feeling prepared (and less stressed) for the festive season ahead. 🎁

Step 4: Prep for Those Big-Ticket Expenses Coming Your Way 💸✨

Step 4: Prep for Those Big-Ticket Expenses Coming Your Way 💸✨

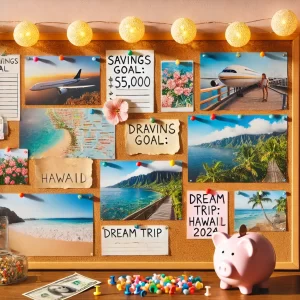

Sure, the holidays are front and center right now, but don’t let those glittery lights distract you from the big goals just around the corner. Whether it’s a dream vacation, a new car, or finally tackling that kitchen remodel, planning ahead now can save you from last-minute financial scrambles—or the dreaded reliance on credit cards.

How to Plan for Big Expenses:

Start a Sinking Fund: Think of it as a savings account with a purpose. Whether it’s for a family getaway, a shiny new laptop, or gulp an unexpected car repair, setting aside a little each month will make it feel less overwhelming.

Prioritize Your Goals: List out your upcoming expenses and rank them by importance. That dream vacation might take precedence over upgrading your backyard patio—or maybe not. You get to decide!

Break It Down: Big projects like home renovations can feel daunting. Try breaking them into smaller, more manageable (and budget-friendly) phases. One room at a time, and your wallet will thank you.

Pro Tip: Planning for big expenses now is like putting the first brick in a solid financial foundation—less stress and more control when the time comes.

Because let’s be real, saving for a dream vacation sounds way more fun than an unexpected car repair…but we all know which one shows up first. 😉

Step 5: Dodge Those Holiday Debt Traps 🎄💳

The holidays can make even the most budget-savvy among us want to swipe our credit cards like there’s no tomorrow. But come January, nobody wants a gift in the form of a hefty credit card bill. Avoid the stress and stick to spending within your means —your future self will thank you!

—your future self will thank you!

Tips for a Debt-Free Holiday:

Go Old School with Cash or Debit: Stick to what you have in your bank account. If you’re using credit cards for rewards, pay off the balance immediately to avoid interest charges.

Set Realistic Gift Expectations: Let your friends and family know that this year is all about thoughtful, budget-friendly gifts. Spoiler alert: They’ll still love you, even if there’s no fancy designer label attached.

Get Creative with Gifts: Homemade treats, meaningful experiences, or gifting your time (hello, babysitting IOUs!) can be way more memorable than store-bought presents. Bonus: These gifts often come with a personal touch that money can’t buy.

Pro Tip: Remember, the holidays are about connection, not consumption. A heartfelt “Merry Christmas” and a warm hug go a lot further than an IOU for that trendy gadget. 😉

Keep the focus on what really matters this season, and step into the new year with zero regrets—and zero debt! 🎁✨

Step 6: Get a Head Start on Next Year’s Financial Goals

Step 6: Get a Head Start on Next Year’s Financial Goals

As the year winds down, it’s a great opportunity to set your sights on next year’s financial aspirations. Whether it’s tackling debt, growing your savings, or planning for retirement, having clear goals and a solid plan will set the tone for a financially successful year ahead.

How to Set Financial Goals for the New Year:

Reflect on This Year’s Finances: Take a moment to review your spending and savings habits. Celebrate what went well, and identify areas where you can tighten up or improve.

Get Specific: Swap vague resolutions like “save more money” for actionable goals such as “save $200 a month for emergencies” or “pay off $1,000 in debt by June.” Clarity is key!

Break It Down: Big goals can feel overwhelming, so divide them into smaller, achievable steps. For example, saving $5,000 a year becomes $417 a month or just $14 a day—suddenly, it feels doable!

Pro Tip: Keep progress, not perfection, as your mantra. Even small wins—like cutting back on dining out or canceling a subscription—can have a big impact over time.

By starting the year with clear financial goals and a step-by-step plan, you’ll set yourself up for success and feel more in control of your money throughout the year. Cheers to a fresh start and a brighter financial future! 🎉💵

Conclusion: Own Your Finances This Fall 🍂💰

As the h olidays creep closer and the new year looms ahead, there’s no better time to take charge of your financial game plan. By setting a realistic holiday budget, trimming unnecessary spending, and mapping out next year’s goals, you can enjoy the festive season with peace of mind—and start the new year feeling empowered.

olidays creep closer and the new year looms ahead, there’s no better time to take charge of your financial game plan. By setting a realistic holiday budget, trimming unnecessary spending, and mapping out next year’s goals, you can enjoy the festive season with peace of mind—and start the new year feeling empowered.

So, light that fall-scented candle, grab a cozy blanket, and sip your favorite tea while you plan your path to financial freedom. Let’s make this the season where you take control, stress less, and focus on what truly matters. You’ve got this—and your bank account will thank you! 🎄✨

if you have enjoyed this post… Please send me some love…share, like and comment ❤️

Connect with Me!

Explore More on Your Journey to Personal Growth and Well-Being: 📚 👓

if you have enjoyed this post… Please send me some love…share, like and comment ❤️

Connect with Me!

For daily doses of inspiration, heartfelt stories, and game-changing wellness strategies, make sure to stay connected.

Natalie Fletcher

Visit my website: RaysofSunlight

Follow me on Facebook: Natalie Fletcher

True Balance Nanaimo: Facebook Page

Connect with me: Linktree

Reach out via Email: 8TrueBalance@gmail.com

Ready to level up your life, both in wellness and wealth? Let’s start this transformative journey together!

Discover more from TrueBalance

Subscribe to get the latest posts sent to your email.